Donate

S4S has a CSR certificate!

Any hotel or business can donate up to half of its CSR tax contribution to eligible projects or organizations. S4S has successfully obtained a CSR certificate from Ministry of Finance, which means that any donations, cash or in-kind contributions made to us can count towards their CSR tax.

Any hotel or business can donate up to half of its CSR tax contribution to eligible projects or organizations. S4S has successfully obtained a CSR certificate from Ministry of Finance, which means that any donations, cash or in-kind contributions made to us can count towards their CSR tax.

Support S4S

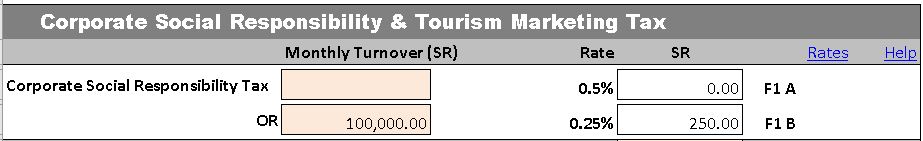

The Corporate Social Responsibility (CSR) Tax was introduced by the Government of Seychelles to benefit the community and is taxed at 0.5% of the monthly turnover of medium and large businesses.

To our business partners - Did you know half of your CSR tax can be paid to a registered non-government organisation such as Sustainability for Seychelles! We have been certified by the government as a recognised organisation to receive donations.

By supporting S4S through your CSR donation you can let the government and community know you want to positively contribute to the protection of the environment.

Please see our newsletter below to show a range of projects we have completed with the help of donations. To keep these projects going we need your help.

For more information, please email us or request a copy of our CSR certificate for your accounts department.

Please see the example below on how to fill in to your Business Activity Statement.

To our business partners - Did you know half of your CSR tax can be paid to a registered non-government organisation such as Sustainability for Seychelles! We have been certified by the government as a recognised organisation to receive donations.

By supporting S4S through your CSR donation you can let the government and community know you want to positively contribute to the protection of the environment.

Please see our newsletter below to show a range of projects we have completed with the help of donations. To keep these projects going we need your help.

For more information, please email us or request a copy of our CSR certificate for your accounts department.

Please see the example below on how to fill in to your Business Activity Statement.

- Fill in your monthly turnover in section F1B (instead of F1A)

- Write a cheque to Sustainability for Seychelles for the remaining 0.25% of your turnover. Depending on the amount you can pay us quarterly, or even annually.

- Submit the BAS form as normal and keep a record of your donation for accounting purposes. S4S will provide you with an official receipt and a copy of our CSR eligibility certificate.

We would like to thank our many sponsors: